(Including Off-Grid Systems)

Across the world, governments are encouraging households to install solar panels, battery storage, and in some cases, go fully off-grid. Here’s a detailed look at current rebates, incentives, and programs you’ll find around the world in 2025.

Australia

Australia leads with strong national and state programs supporting both grid-tied and off-grid solar.

Federal Incentives

- Small-scale Renewable Energy Scheme (SRES):

Eligible solar and battery systems create Small-scale Technology Certificates (STCs), delivering an upfront discount.- A typical 6.6kW solar system might attract $2,400–$3,000 worth of STCs.

- Off-grid systems fully qualify for STCs, giving rural households the same benefits as grid-connected homes.

State Incentives

- Victoria – Solar Homes Program:

- Solar panel rebate up to $1,400.

- Battery rebate up to $3,500.

- 0% interest loans up to $8,800 for solar and up to $14,000 for batteries.

- Available for existing homes, new builds, and rental properties under certain conditions.

- NSW – Empowering Homes Program:

- Up to $14,000 interest-free loans for solar and battery installs in selected postcodes.

- Queensland – Home Energy Upgrades:

- $3,000 rebate for new solar systems and another $3,000 for battery storage, targeting low- and middle-income households.

- ACT – Sustainable Household Scheme:

- 0% interest loans up to $15,000 for solar panels, batteries, or combined systems.

- Northern Territory – Solar Energy Transformation Program (SETuP) and Home Battery Scheme (closed 2023):

- Rebates of up to $6,000 for batteries were available; some interest-free finance options remain through local banks.

Off-Grid Support

- Federal STCs:

Off-grid systems still claim STCs based on expected generation over 15 years. - Remote Area Energy Support:

Some regional councils and programs (e.g., Remote Power Systems Program WA) offer top-ups for truly remote installations.

United States

American homeowners benefit from strong federal tax credits and state-specific programs, many of which support batteries and off-grid systems too.

Federal Incentives

- Investment Tax Credit (ITC):

- 30% of total installed cost credited back through your tax return.

- Applies to both solar PV and battery systems (battery must have ≥3kWh capacity).

- Residential Clean Energy Credit (Inflation Reduction Act, 2022):

- Covers standalone battery storage, even without solar panels, provided 100% renewable charging.

State and Local Programs

- California – Self-Generation Incentive Program (SGIP):

- Battery rebate between $150 and $1,000 per kWh installed, depending on household income and grid vulnerability.

- New York – NY-Sun Program:

- Up to $1,000/kW rebate for solar systems, plus additional $250/kW if paired with batteries.

- Low-income households qualify for larger rebates under the Affordable Solar Program.

- Massachusetts – SMART Program:

- Fixed tariff payments for solar energy production, with additional incentives for battery-paired systems.

- Nevada and Maryland:

Offer separate solar tax credits (e.g., 40% state tax deduction in Nevada up to $10,000). - Net Metering Policies:

Offered in over 30 states, though evolving (e.g., California’s NEM 3.0 shifts to time-of-export pricing).

Off-Grid Support

- USDA REAP Grants:

- Up to 50% funding for renewable energy projects in rural areas, including off-grid homes.

- ITC for Off-Grid Systems:

- Full 30% tax credit applies to off-grid solar+battery setups.

Europe

European countries tend to favour tax deductions, zero VAT, feed-in tariffs, and battery grants.

Germany

- KfW 270 and 275 Loans:

- Government-backed low-interest loans for solar PV systems and batteries.

- Up to 100% of project costs covered under certain conditions.

- VAT Refunds:

- 0% VAT on new residential solar installations introduced from 2023.

- Self-Consumption Exemptions:

- No grid surcharges for owners using ≤30kW systems primarily for self-use.

United Kingdom

- Zero VAT:

Residential solar and battery systems are VAT-free until at least March 2027. - Smart Export Guarantee (SEG):

- Requires large electricity suppliers to pay homeowners for excess solar exported back to the grid.

- Export rates typically range from 5p–10p per kWh.

- Local Council Schemes:

- Some councils and energy suppliers offer small grants or free assessments.

France

- CITE (Tax Credit for Energy Transition):

- 15% tax credit on eligible PV costs up to €600, phased out into MaPrimeRénov in some areas.

- Eco-PTZ:

- Up to €30,000 in zero-interest loans for home solar and battery upgrades.

Italy

- Ecobonus and Superbonus Schemes:

- 50% deduction (Ecobonus) over 10 years for standard solar+battery installs.

- The 110% Superbonus expired in 2023, but special local schemes remain.

- Net Metering:

Offered through “scambio sul posto” with full or partial bill credits.

Spain

- Zero VAT on Solar (since 2022):

Applies to residential solar panels. - Plan MOVES III:

- Provides grants for solar battery installations, especially when integrated with electric vehicles.

- Net Billing:

Guaranteed payments for exported solar under Royal Decree 244/2019.

Off-Grid Europe

- Nordic Countries (Sweden, Norway):

Small grants available for off-grid cabins and isolated farmhouses. - EU Rural Energy Grants:

Available for very remote agricultural properties.

Asia

Asia offers a mix of government-backed subsidies and net metering schemes.

China

- Green Certificate Market:

Rooftop solar now mainly monetises by selling green certificates. - Local Subsidies:

Some provinces still offer rebates for distributed solar under city-level initiatives.

India

- MNRE Rooftop Solar Programme Phase II:

- Up to 40% capital subsidy for systems up to 3kW.

- 20% subsidy for systems between 3–10kW.

- State Top-Ups:

- Additional rebates (e.g., Delhi Solar Policy offers extra ₹10,000/kW rebate).

- Tax Benefits:

Section 80EEB of India’s tax code offers income tax deductions for renewable energy loans.

Japan

- Local Subsidies:

- Grants from prefectures and councils for battery-backed solar systems.

- V2H incentives available for EV-connected battery storage.

Southeast Asia

- Malaysia – Net Energy Metering (NEM) 3.0:

- Allows households to export excess solar and receive bill credits.

- Thailand:

- Net metering with 2–3 baht/kWh export prices capped at certain system sizes.

- Philippines:

- Net metering policy nationwide since 2013.

Off-Grid Asia

- Bangladesh Solar Home Systems (SHS) Project:

- Over 4 million off-grid home solar kits installed, backed by IDCOL and World Bank funding.

- India’s DDG Scheme:

- Decentralised Distributed Generation grants for mini-grid solar and off-grid villages.

Africa and Middle East

Most incentives in these regions target rural electrification and energy access, not mainstream solar rebates.

South Africa

- Net Metering and Feed-in Tariffs:

- Available in major cities like Cape Town and Johannesburg.

- Self-generation under 100kW exempt from full licensing.

- Solar Tax Incentives:

- Mainly aimed at businesses through Section 12B accelerated depreciation.

Kenya, Nigeria, Tanzania

- Solar VAT and Duty Exemptions:

- Most solar panels and batteries are exempt from import taxes.

- Private Microgrid Development:

- Strong push for private solar mini-grids under donor-funded programs.

UAE and Morocco

- UAE (Dubai, Abu Dhabi):

- Residential net metering schemes operational through DEWA and ADDC.

- Morocco:

- Focus remains on large-scale solar projects, though rooftop pilot programs are expanding.

Off-Grid Africa

- Lighting Africa Program:

Funded by the World Bank, promoting off-grid solar kits across sub-Saharan Africa. - SmartVillages:

An international program supporting mini-grid development and rural electrification.

Global Off-Grid Incentives

Off-grid-specific support includes:

Africa:

Donor-led programs like Lighting Africa drive off-grid adoption across multiple countries.

Australia:

STCs available even for off-grid solar homes.

USA:

USDA REAP grants and 30% ITC support rural off-grid systems.

India and Bangladesh:

Major rural electrification grants support millions of solar home systems.

- Africa:

Donor-led programs like Lighting Africa drive off-grid adoption across multiple countries.

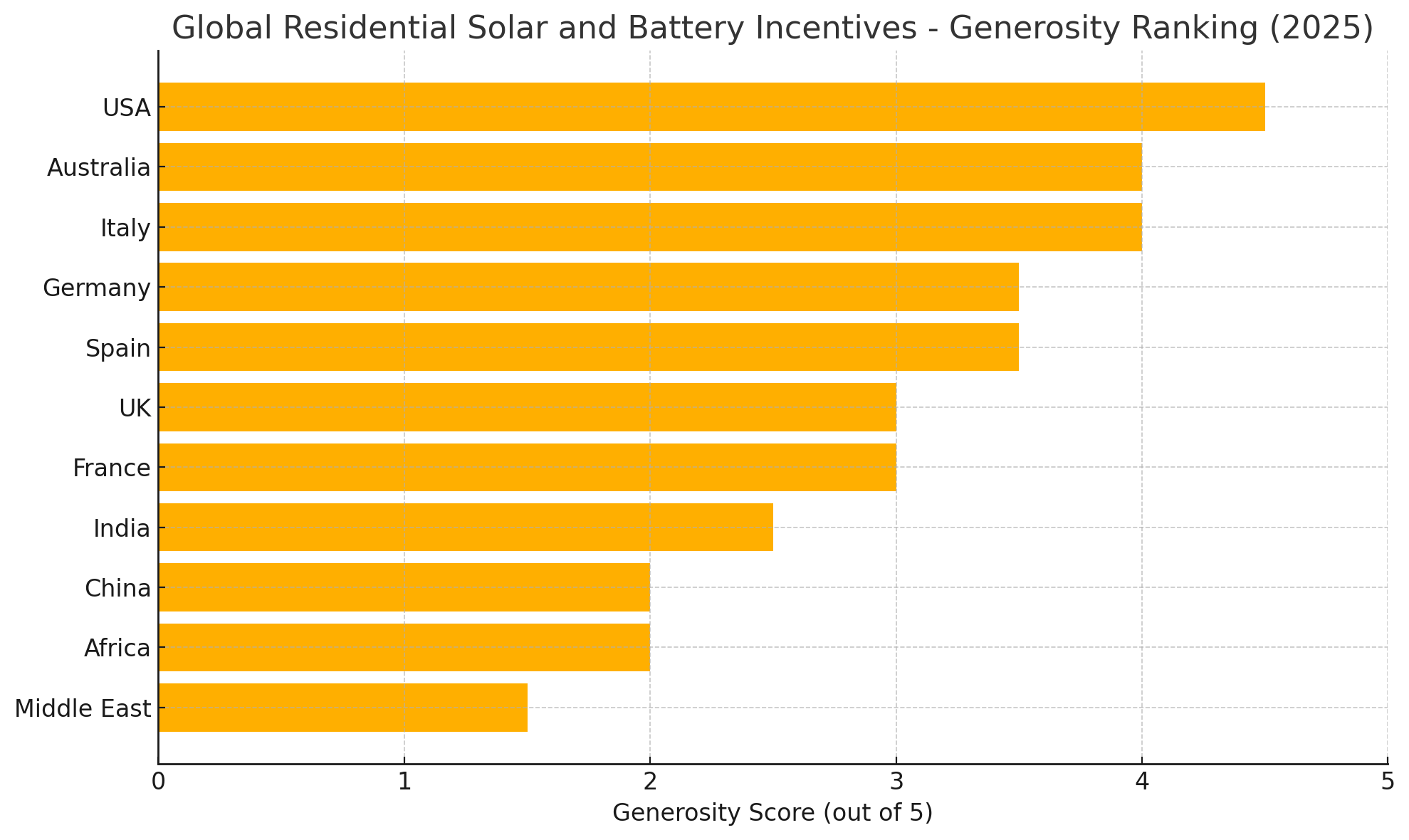

Solar and Battery Incentives: Which Are the Most Generous (2025)?

| Country/Region | Generosity Score | Summary |

|---|---|---|

| 🇺🇸 USA (Federal + State) | ⭐⭐⭐⭐½ | 30% federal tax credit (solar + batteries), plus generous state rebates (e.g. SGIP $1,000/kWh for low-income). REAP grants up to 50% for rural/off-grid. |

| 🇦🇺 Australia (Federal + States) | ⭐⭐⭐⭐ | National STCs worth $2,500–$4,000 upfront, plus state rebates (up to $3,500 battery rebate Victoria, $14,000 loan NSW). Off-grid systems eligible for same federal rebates. |

| 🇪🇺 Italy | ⭐⭐⭐⭐ | 50% income tax deduction (Ecobonus), net metering available. Used to have 110% Superbonus, now scaled back. |

| 🇪🇺 Germany | ⭐⭐⭐½ | 0% VAT, cheap KfW loans for solar + batteries, self-consumption exemptions. No direct cash rebates now. |

| 🇪🇺 Spain | ⭐⭐⭐½ | 0% VAT on residential solar, net billing law paying for exported solar, grants for batteries under Plan MOVES. |

| 🇬🇧 United Kingdom | ⭐⭐⭐ | 0% VAT, small export payments (SEG ~5–10p/kWh). No upfront rebates or major cash incentives. |

| 🇫🇷 France | ⭐⭐⭐ | 15% tax credit, zero-interest Eco-PTZ loans. Local grants limited compared to others. |

| 🇮🇳 India | ⭐⭐½ | Up to 40% upfront subsidy on small solar systems (good), but limited to on-grid rooftop. Strong rural off-grid grants. |

| 🇨🇳 China | ⭐⭐ | Mostly ended national feed-in tariffs. Some local subsidies exist, but mostly market-driven now. |

| 🌍 Africa (Kenya, Nigeria, SA) | ⭐⭐ | No real cash incentives. Focus is on VAT exemptions + rural off-grid funding via NGOs. |

| 🇦🇪 UAE / 🇲🇦 Morocco | ⭐½ | Some net metering available, but no direct solar or battery rebates for homeowners. Focus is on large solar farms. |

Quick Ranking

| Rank | Most Generous Solar and Battery Incentives |

|---|---|

| 🥇 1st Place | USA — 30% federal tax credit + strong state rebates, plus rural off-grid grants. |

| 🥈 2nd Place | Australia — Strong federal STC program + major state cash rebates and loans. |

| 🥉 3rd Place | Italy — 50% long-term tax deduction + solid net metering laws. |

| 4th | Germany — 0% VAT + low-interest financing, but less upfront cash now. |

| 5th | Spain — Good for 0% VAT + battery grants under EV schemes. |

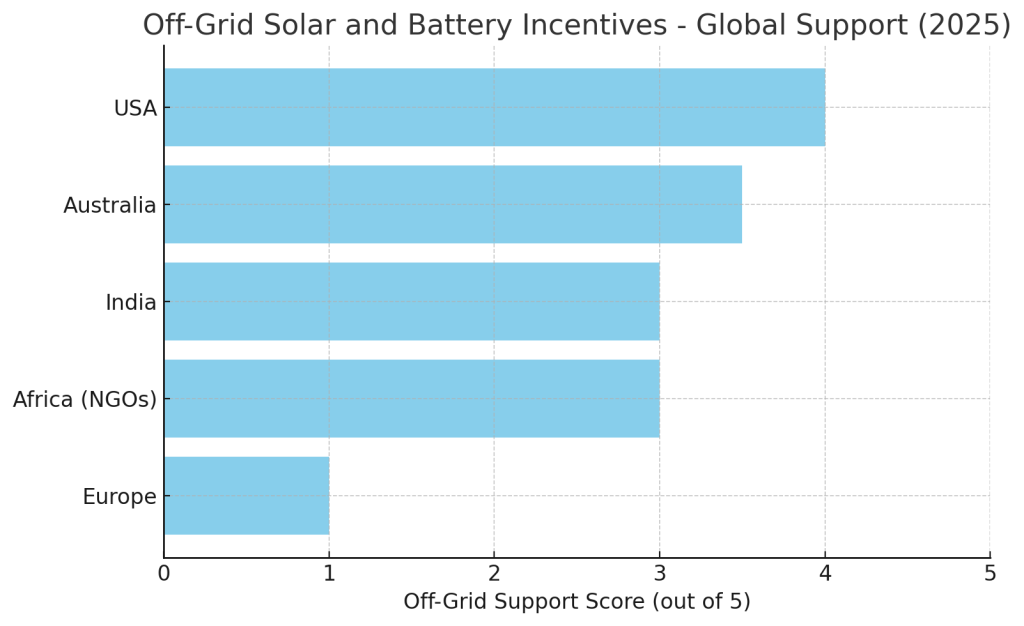

Off-Grid Incentives (Special Focus)

| Country/Region | Support for Off-Grid Solar | Notes |

|---|---|---|

| 🇺🇸 USA | ⭐⭐⭐⭐ | USDA REAP grants (up to 50%), ITC covers off-grid systems. |

| 🇦🇺 Australia | ⭐⭐⭐½ | Federal STCs apply equally to off-grid, but state programs vary. |

| 🇮🇳 India | ⭐⭐⭐ | Separate funding for village mini-grids and solar pumping. |

| 🌍 Africa (NGO support) | ⭐⭐⭐ | Strong grant-based off-grid support, but not direct cash incentives to private households. |

| 🇪🇺 Europe | ⭐ | Off-grid support rare outside specific Nordic regions. |

Summary

- USA currently has the most generous combination of solar and battery incentives, especially for rural and off-grid setups.

- Australia is a strong second, with excellent national and state support and easier access for off-grid installations.

- Italy and Germany lead Europe, though most incentives come through tax deductions rather than upfront cash.

- Spain offers a decent mix with new VAT-free status and battery grants, but not as strong as Australia or the USA.

- Africa and Asia have strong off-grid program support but fewer direct rebates for general households.

Off-Grid Solar Incentive Support (2025)

If you’re planning to go fully off-grid, the best support comes from the USA and Australia.

Both countries offer strong financial incentives, including tax credits, rebates, and grants that apply equally to off-grid homes.

India and Africa also provide substantial backing, mainly through government and donor-funded programs aimed at rural energy access.

In Europe, most incentives focus on grid-connected systems, with very limited formal support for residential off-grid projects.

Choosing the right location — and matching your system to available incentives — can make off-grid living more achievable and affordable than ever before.

If you’re planning to go fully off-grid, the best support comes from the USA and Australia.

Both countries offer strong financial incentives, including tax credits, rebates, and grants that apply equally to off-grid homes.

India and Africa also provide substantial backing, mainly through government and donor-funded programs aimed at rural energy access.

In Europe, most incentives focus on grid-connected systems, with very limited formal support for residential off-grid projects.

Choosing the right location — and matching your system to available incentives — can make off-grid living more achievable and affordable than ever before.